Insurance

affordable car insurance, auto insurance comparison, auto insurance policy, auto insurance tips, best car insurance, car insurance benefits, car insurance cost, car insurance discounts, car insurance for high-risk drivers, car insurance full coverage, car insurance guide, car insurance protection, car insurance quotes, car insurance requirements, car insurance terms

Admin

The Best Guide to Full Coverage Car Insurance

Key Takeaways

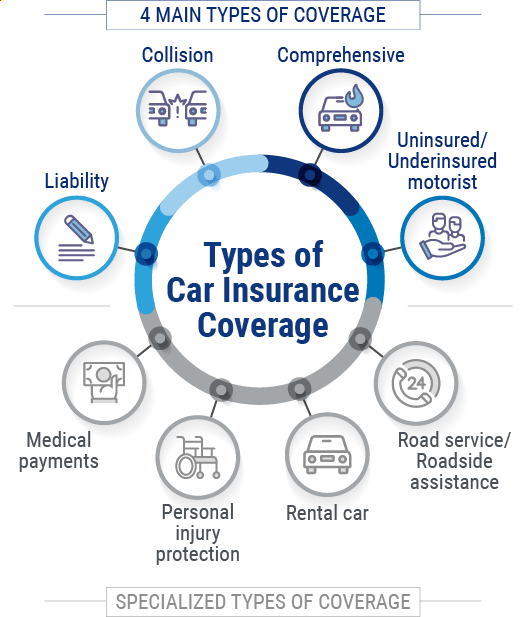

- Full coverage includes liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments/PIP.

- It offers broad protection but is not all-inclusive.

- Best for new, expensive, or financed vehicles.

- Costs vary widely based on personal and vehicle-related factors.

- Optional add-ons like gap insurance and roadside assistance can enhance coverage.

- It’s possible to lower premiums through various strategies.

- Always review and reassess your coverage needs periodically.

Car Insurance Full Coverage: Everything You Need to Know

Introduction

In today’s fast-paced world, owning a vehicle is often a necessity. But with vehicle ownership comes the responsibility of protecting yourself, your passengers, and your investment. Car insurance is a legal and financial safeguard that every driver must consider seriously. Among the various types of car insurance available, full coverage is often seen as the most comprehensive and secure option. But what exactly does “full coverage” mean? Is it truly all-encompassing? And how can you determine if it’s the right choice for you?

This article dives deep into the concept of full coverage car insurance, exploring its components, benefits, limitations, costs, and more. Whether you’re a new driver or someone looking to upgrade your current policy, this comprehensive guide will equip you with all the information you need to make an informed decision.

What is Full Coverage Car Insurance?

“Full coverage” is a term commonly used in the insurance industry, but it doesn’t refer to a specific policy or legal definition. Instead, it typically encompasses a combination of several types of car insurance that together provide extensive protection. A full coverage policy generally includes:

- Liability Insurance

- Bodily Injury Liability: Covers injuries to others if you’re at fault.

- Property Damage Liability: Covers damage to others’ property.

- Collision Coverage

- Pays for damage to your vehicle resulting from a collision, regardless of fault.

- Comprehensive Coverage

- Covers non-collision incidents like theft, vandalism, natural disasters, fire, and falling objects.

- Personal Injury Protection (PIP)

- Covers medical expenses, lost wages, and sometimes funeral costs for you and your passengers, regardless of fault.

- Medical Payments Coverage (MedPay)

- Pays for medical expenses for you and your passengers after an accident, regardless of fault.

- Uninsured Motorist Coverage (UM)

- Covers your costs if you’re hit by a driver without insurance.

- Underinsured Motorist Coverage (UIM)

- Kicks in when the at-fault driver’s insurance isn’t enough to cover your expenses.

- Gap Insurance

- Pays the difference between what you owe on a car loan or lease and the car’s actual value if it’s totaled.

- Rental Reimbursement Coverage

- Pays for a rental car while your vehicle is being repaired after a covered loss.

- Roadside Assistance Coverage: Provides services like towing, battery jump-starts, and flat tire changes.

- Custom Parts and Equipment Coverage: Covers aftermarket or custom parts that aren’t included in standard policies.

- Mechanical Breakdown Insurance: Helps cover repair costs for mechanical failures, similar to an extended warranty.

While “full coverage” offers broad protection, it’s important to note that no insurance policy covers every possible scenario. Optional add-ons and exclusions often apply.

Why Full Coverage Might Be Right for You

Full coverage car insurance is often recommended in the following scenarios:

- New or Expensive Vehicles: If you drive a new or high-value car, full coverage can protect your investment.

- Leased or Financed Cars: Lenders usually require full coverage to protect their collateral.

- High-Risk Areas: Living in areas with high theft, vandalism, or accident rates may warrant full protection.

- Peace of Mind: For many, the comprehensive nature of full coverage offers mental and financial peace of mind.

Components of Full Coverage Car Insurance

1. Liability Insurance

This is the most basic and legally required type of coverage in most states. It covers:

- Bodily injuries to others

- Property damage to others’ vehicles or property

2. Collision Insurance

This component covers:

- Damages to your car in a collision

- Accidents regardless of fault

- Hit-and-run incidents (in some policies)

3. Comprehensive Insurance

This pays for:

- Natural disasters (hurricanes, floods, earthquakes)

- Theft and vandalism

- Falling objects (like tree branches)

- Fire or explosions

4. Uninsured/Underinsured Motorist Coverage

This helps when:

- You’re hit by a driver with no or insufficient insurance

- You’re involved in a hit-and-run accident

5. Medical Payments or PIP

This covers:

- Hospital and medical bills

- Funeral costs

- Lost wages (under PIP)

- Rehabilitation services

Pros and Cons of Full Coverage Car Insurance

Pros

- Comprehensive Protection: Covers a wide range of scenarios

- Peace of Mind: Less worry about out-of-pocket expenses

- Mandatory for Leased Vehicles: Often a requirement by lenders

- Added Security: Better protection against uninsured drivers

Cons

- Cost: Significantly more expensive than liability-only coverage

- Deductibles: Out-of-pocket expenses still apply before claims are paid

- Not Always Necessary: Older, low-value cars may not need full coverage

How Much Does Full Coverage Cost?

The cost of full coverage varies based on several factors:

- Age and Gender: Younger and male drivers usually pay more

- Driving Record: Clean records get better rates

- Location: Urban areas tend to have higher premiums

- Vehicle Type: Luxury and sports cars cost more to insure

- Credit Score: In many states, this affects your premium

Average Annual Premium: As of recent data, the average annual cost for full coverage in the U.S. is approximately $1,700.

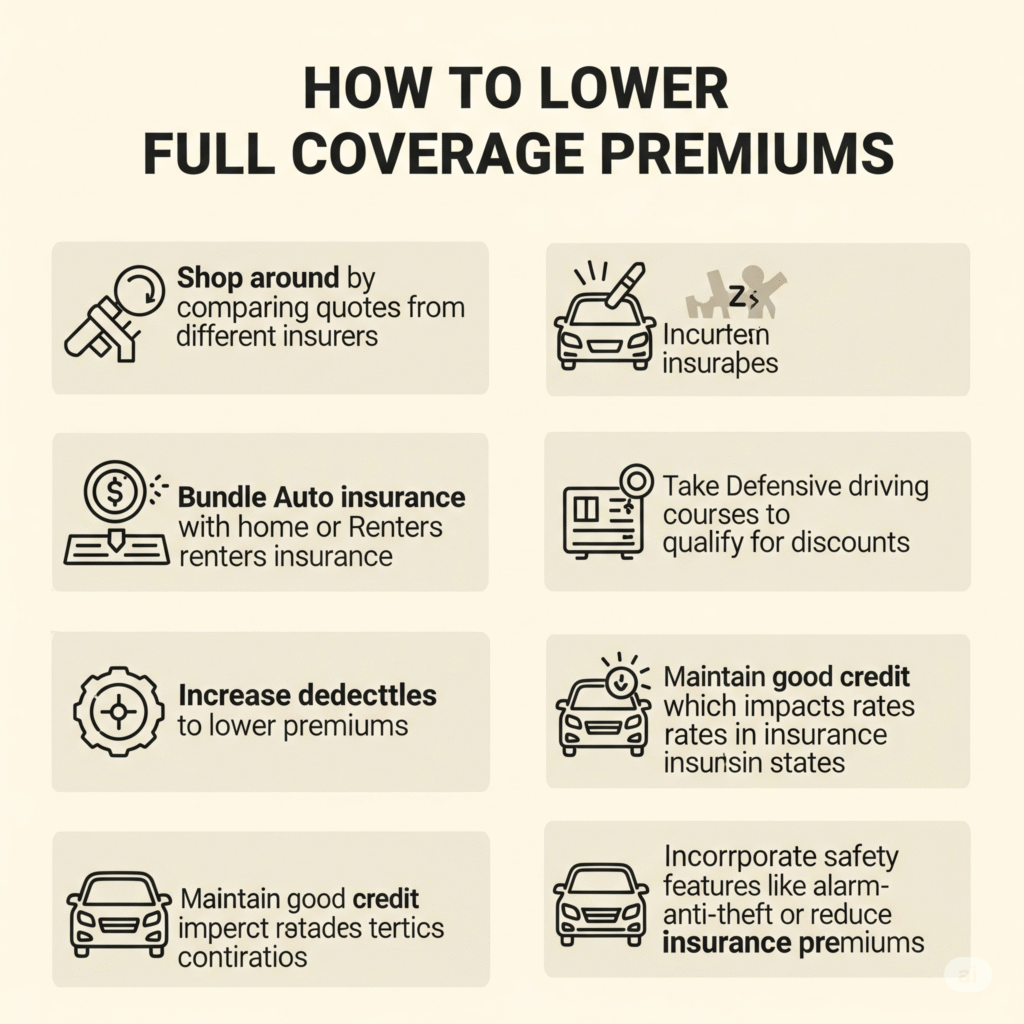

How to Lower Full Coverage Premiums

- Shop Around: Compare quotes from multiple insurers

- Bundle Policies: Combine auto with home or renters insurance

- Increase Deductibles: Higher deductibles mean lower premiums

- Take Defensive Driving Courses: Can qualify for discounts

- Maintain Good Credit: Helps in states where credit score matters

- Install Safety Features: Alarms and anti-theft devices can lower rates

Common Myths About Full Coverage

- Myth: Full coverage covers everything

- Reality: It doesn’t cover wear and tear, maintenance, or rental cars (unless added).

- Myth: It’s mandatory by law

- Reality: Only liability is legally required; full coverage is optional.

- Myth: It covers medical bills entirely

- Reality: Only up to policy limits and based on PIP/MedPay selection.

- Myth: You can’t customize full coverage

- Reality: You can add or remove components based on needs.

When Should You Drop Full Coverage?

- Car Value Drops Below $4,000: Insurance payout may not justify premium cost

- You Own the Vehicle Outright: No lender requirements

- Your Financial Situation Changes: Budget constraints may necessitate adjustments

- Vehicle is Rarely Used: Lower risk might not require full protection

Also Read:https://shvh.shop/category/insurance/

Conclusion

Full coverage car insurance offers a high level of financial protection, combining multiple types of coverage into a single policy. While it’s not mandatory, it is highly recommended for those with new, valuable, or financed vehicles. Like all financial decisions, choosing full coverage requires careful consideration of your vehicle’s value, your budget, and your risk tolerance. By understanding what full coverage includes and doesn’t include, you can make a more informed choice that best protects you and your vehicle.

(FAQs)

- Is full coverage car insurance required by law?

- No, only liability insurance is legally mandated. Full coverage is optional but often recommended.

- Does full coverage cover rental cars?

- Not automatically. Some policies include rental reimbursement as an add-on.

- Can I choose my deductible for full coverage?

- Yes, most insurers allow you to select your deductibles for both collision and comprehensive parts.

- Will full coverage pay off my car loan if it’s totaled?

- Not necessarily. You may need gap insurance to cover the loan balance.

- Does full coverage include roadside assistance?

- Not by default. This is usually an optional service you can add.

- Can I switch to liability-only at any time?

- Yes, but it’s best to evaluate whether it meets your current needs and risks.

- How can I find the best full coverage policy?

- Compare quotes, check coverage options, review customer feedback, and consult with an insurance agent.