Insurance

affordable homeowners insurance, best home insurance, buying homeowners insurance, compare home insurance, dwelling coverage, fire insurance, flood insurance policy, home insurance benefits, home insurance coverage, home insurance FAQs, home insurance guide, home insurance policy, home insurance premium, home insurance tips, home protection, homeowners insurance, homeowners policy, insurance claim process, insurance cost, insurance deductible, insurance for house, insurance quotes, insurance savings, is homeowners insurance worth it, liability coverage, natural disaster insurance, personal property insurance, property insurance, renters vs homeowners insurance

Admin

Is Homeowners Insurance Worth The Cost?

Homeowners insurance is one of those financial decisions that often sparks debate. On one hand, it’s an extra expense added to the cost of owning a home. On the other, it can be a financial lifesaver during times of crisis. So, is homeowners insurance truly worth the cost? Let’s break it down in terms of value, coverage, and real-life benefits.

Key Takeaway

Homeowners insurance is a small price to pay for significant financial security. Whether it’s protecting your home’s structure, belongings, or shielding you from liability, the cost is justified by the coverage. Evaluate your needs, compare quotes, and choose a policy that balances protection and affordability.

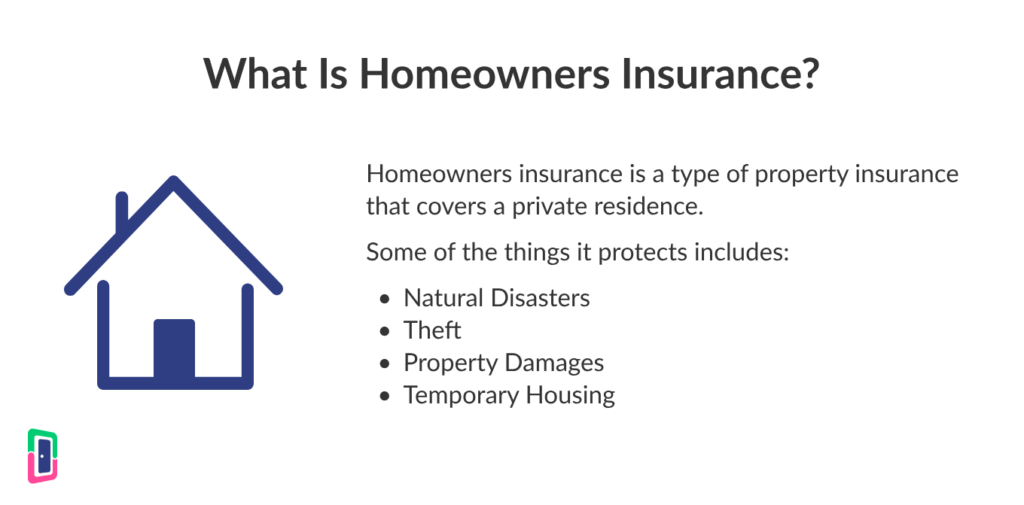

What Is Homeowners Insurance and Why Does It Matter?

Homeowners insurance is a policy that protects you from financial loss due to damage or destruction to your home, personal belongings, or liability if someone gets injured on your property. It is typically required by mortgage lenders but also offers peace of mind for all homeowners.

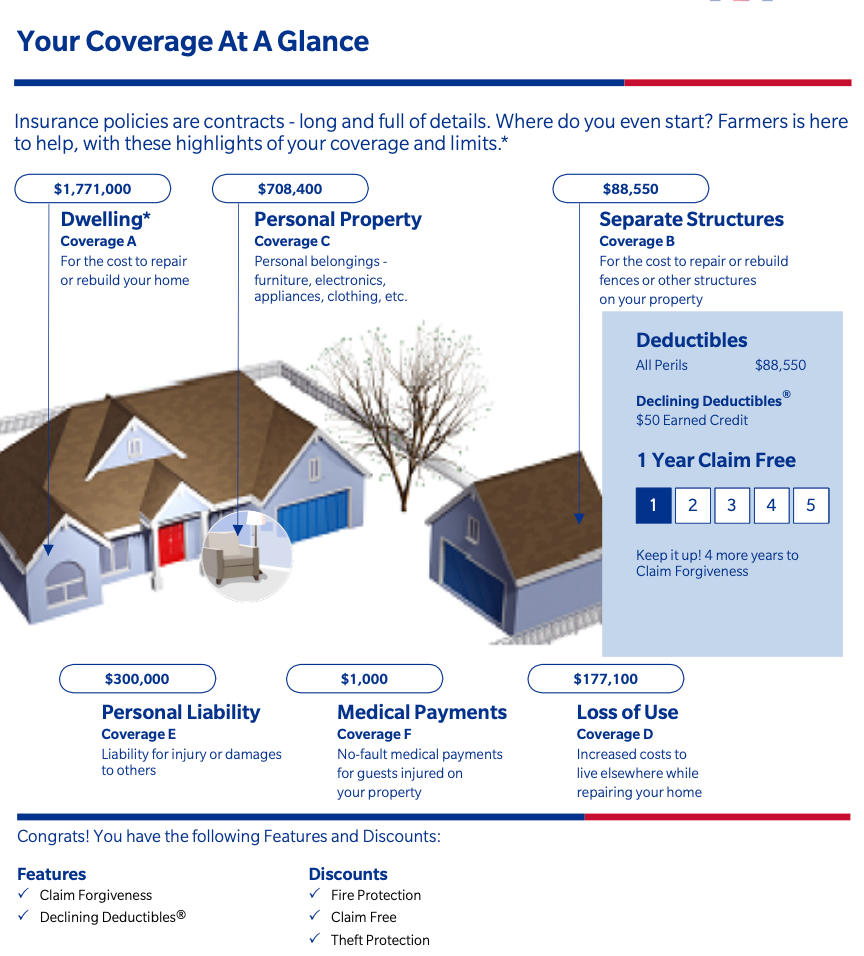

What Does a Standard Policy Usually Cover?

A typical homeowners insurance policy includes:

- Dwelling coverage: For damage to the physical structure of your home.

- Personal property coverage: For your belongings like furniture, electronics, and clothes.

- Liability protection: If someone gets injured on your property and sues you.

- Additional living expenses (ALE): Covers temporary living costs if your home becomes uninhabitable.

How Much Does Homeowners Insurance Cost?

The cost varies widely depending on factors like your home’s location, value, age, and the type of coverage you select. On average, Americans pay between $1,200 to $2,000 per year.

Factors That Influence the Cost

- Location (risk of natural disasters, crime rates)

- Home value and size

- Construction materials

- Claims history

- Coverage limits and deductibles

- Credit score

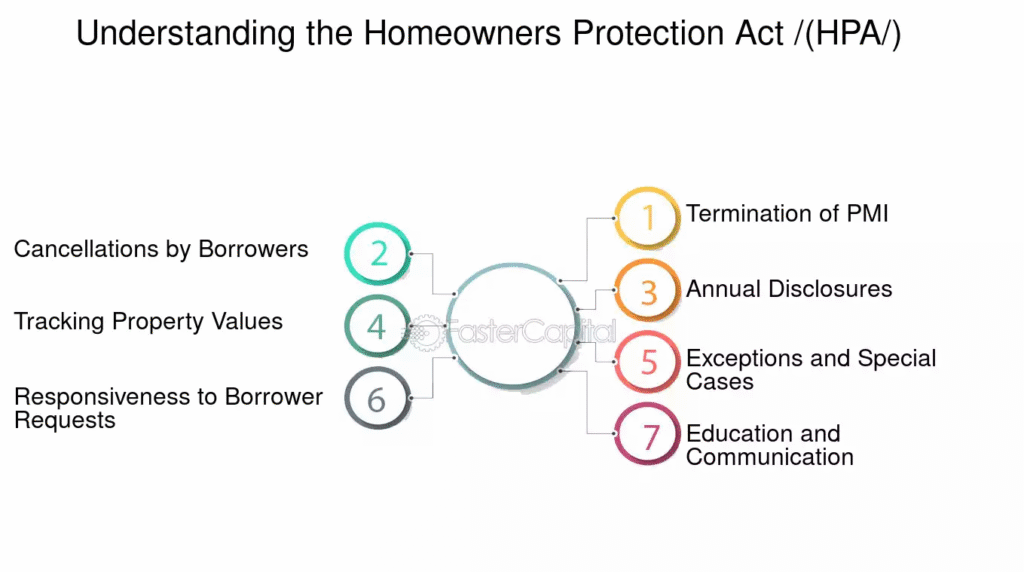

Is It Legally Required to Have Homeowners Insurance?

No, there’s no federal or state law that mandates homeowners insurance. However, if you’re financing your home through a mortgage lender, they will almost always require it.

When Does Homeowners Insurance Pay Off?

Homeowners insurance pays off in scenarios like:

- Fire damage: Replacing your entire home could cost hundreds of thousands.

- Natural disasters (depending on coverage): Windstorms, hail, and more.

- Theft or vandalism: Recovering stolen items or repairing damage.

- Lawsuits: Liability coverage protects your assets.

- Temporary displacement: ALE can save you thousands in hotel and food costs.

When Might Homeowners Insurance Not Be Worth It?

In rare situations where:

- You own your home outright and can afford to self-insure

- You live in a very low-risk area

- You have a high deductible and low coverage, making small claims impractical

Even then, the financial risk of catastrophic damage usually outweighs the cost of the policy.

What Are the Hidden Benefits of Homeowners Insurance?

Peace of Mind

Knowing that your investment is protected reduces stress and worry.

Financial Safety Net

Most people don’t have $200,000+ lying around to rebuild a home from scratch.

Legal Protection

Covers legal fees if someone sues you due to an accident on your property.

Protection for Valuables

Some policies cover jewelry, electronics, and even antiques—especially if you add a rider.

How to Make the Most of Your Homeowners Insurance

1. Review Your Coverage Annually

Ensure it reflects the current value of your home and possessions.

2. Bundle with Other Policies

You may get up to 25% off if you bundle with auto or life insurance.

3. Raise Your Deductible

A higher deductible lowers your premium—just ensure you can afford it if needed.

4. Shop Around

Get quotes from multiple insurers every few years.

Conclusion

In almost every scenario, the answer is yes. The potential losses from events like fire, theft, or natural disasters are too great to ignore. Homeowners insurance not only protects your investment but also shields you from legal and personal liability risks. The peace of mind and financial protection it provides are worth far more than the annual premium.

Even if you never file a claim, homeowners insurance acts as a safety net—just like seatbelts or health insurance. You hope you never need it, but when you do, you’ll be grateful it’s there.

Also Read :- How to finance your MBA without going into debt

FAQs

1. Does homeowners insurance cover flood damage?

No. You need a separate flood insurance policy, often from the National Flood Insurance Program (NFIP).

2. Will it cover damage caused by termites or mold?

Usually not. These are considered maintenance issues, not sudden or accidental damage.

3. Can I choose how much coverage I want?

Yes, within limits. Your lender may require a minimum, but you can increase coverage or add riders.

4. What if my dog bites someone?

Most policies include liability coverage, but some insurers exclude certain dog breeds.

5. How fast do insurers pay out claims?

Typically within a few days to a few weeks, depending on the severity and documentation.

6. Does it cover detached structures like garages or sheds?

Yes, under the “Other Structures” part of the policy—usually around 10% of dwelling coverage.

7. Is home insurance tax deductible?

Generally, no—unless you use part of your home for business purposes.