Loan

alternative lending, bank loans, best loan deals, business credit, Business Loan, commercial loan, credit score loan, fast business loan, invoice financing, line of credit, Loan Application, loan approval, loan comparison, Loan Eligibility, loan for entrepreneurs, Loan Rates, loan terms, low interest loan, microloans, online lenders, peer to peer loans, Personal Loan, refinance loan, SBA loan, secured loan, small business loan, startup financing, term loan, Unsecured Loan, working capital loan

Admin

Where Can I Get the Best Business Loan Rates Today?

Understanding Business Loan Rates

Business loan rates are the interest rates charged on the borrowed amount. These rates vary based on several factors:

- Credit Score: Lenders assess your personal and business credit history.

- Loan Amount & Term: Larger amounts and longer terms may have different rate structures.

- Type of Loan: Term loans, lines of credit, equipment loans, and SBA loans all have different typical rates.

- Collateral: Secured loans usually offer lower rates.

- Lender Type: Banks, credit unions, and online lenders all offer different rates.

Understanding these variables can help you identify lenders offering the best deals for your situation.

Key Takeaways

- Business loan rates vary widely, from as low as 6% to over 30%, depending on lender and risk factors.

- Traditional banks and SBA loans offer the most competitive rates but have stricter requirements.

- Online lenders provide speed and accessibility, often at a higher cost.

- Comparing multiple lenders and understanding APR, terms, and fees is critical.

- Improving your credit score and financial profile can lead to better loan offers.

Careful planning, research, and negotiation will help you secure the best possible

Where to Find the Best Business Loan Rates Today

Traditional Banks

Banks offer some of the lowest interest rates, especially for established businesses with strong credit histories.

- Pros:

- Low interest rates

- Long-term relationships and additional financial services

- Cons:

- Lengthy approval processes

- Strict eligibility requirements

Top Banks for Business Loans:

- Wells Fargo

- Chase Bank

- Bank of America

Credit Unions

Credit unions are member-owned and often provide competitive rates to small businesses.

- Pros:

- Lower fees and interest rates

- Personalized service

- Cons:

- Limited to members

- Fewer loan options compared to larger banks

Online Lenders

Fintech companies have disrupted traditional lending with fast, flexible loans and user-friendly digital platforms.

- Pros:

- Quick application and approval process

- Lenient eligibility criteria

- Cons:

- Higher interest rates

- Shorter loan terms

Popular Online Lenders:

- BlueVine

- Kabbage

- OnDeck

Small Business Administration (SBA) Loans

SBA loans are partially guaranteed by the government, making them less risky for lenders.

- Pros:

- Competitive interest rates

- Longer repayment terms

- Cons:

- Lengthy application process

- Strict documentation requirements

Types of SBA Loans:

- 7(a) Loan Program

- 504 Loan Program

- Microloans

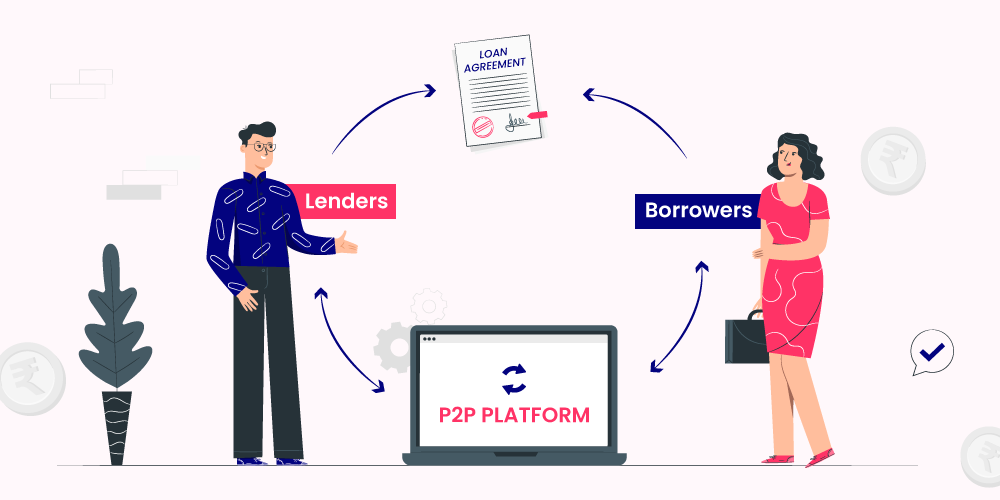

Peer-to-Peer Lending Platforms

These platforms connect borrowers directly with individual or institutional investors.

- Pros:

- Fast funding

- Flexible terms

- Cons:

- Rates vary based on perceived risk

- May lack customer support

Alternative Lenders

These include merchant cash advance providers, invoice factoring companies, and microfinance organizations.

- Pros:

- Accessible for businesses with poor credit

- Fast capital

- Cons:

- High interest rates and fees

- Short repayment periods

Factors That Influence Business Loan Rates

Creditworthiness

Your credit score, history, and financial statements will directly impact the interest rate offered.

Loan Amount and Term

Shorter-term loans may have lower rates but higher monthly payments.

Collateral and Risk

Secured loans generally offer lower rates because they pose less risk to lenders.

Business Age and Revenue

Startups may face higher rates compared to well-established, profitable companies.

Economic Conditions

Interest rates can fluctuate based on broader economic trends and monetary policy decisions.

How to Compare Business Loan Offers

Choosing the right business loan goes beyond just looking at interest rates. A loan with a lower rate might still cost more in the long run if it includes high fees or unfavorable repayment terms. Here’s a detailed breakdown of what you should evaluate when comparing loan offers:

Annual Percentage Rate (APR)

The APR is one of the most important figures when comparing loan offers. It includes:

- Interest rate

- Origination fees

- Processing fees

- Other mandatory charges

Why it matters: The APR gives you the true cost of the loan on an annual basis, making it easier to compare offers from different lenders.

Example:

- Loan A: 8% interest, 3% fees → APR = ~11%

- Loan B: 10% interest, 0% fees → APR = ~10%

Loan B is actually cheaper, even with a higher base rate.

Loan Terms

The term refers to the length of time you have to repay the loan. Common terms include:

- Short-term (6–18 months)

- Medium-term (1–3 years)

- Long-term (5–25 years, often for SBA loans)

Why it matters:

Longer terms reduce monthly payments but may increase total interest paid over time. Choose a term that matches your cash flow and growth timeline.

Repayment Structure

Understand how and when you’ll make payments:

- Frequency: Daily, weekly, bi-weekly, or monthly

- Type: Fixed payments or fluctuating payments

- Method: Auto-debit, manual payment, or revenue-based repayments

Why it matters:

Frequent repayments (daily or weekly) can strain cash flow for small businesses. Monthly payments offer more flexibility.

Fees and Penalties

Always ask for a breakdown of all fees, including:

- Origination fees (1–5% of loan amount)

- Prepayment penalties

- Late payment fees

- Underwriting or document fees

- Annual maintenance fees (for lines of credit)

Why it matters:

A loan with low interest but high fees can be more expensive than one with higher rates and no fees.

Collateral Requirements

Some loans require assets as security, such as real estate, inventory, or equipment. Others are unsecured but may come with higher rates.

Why it matters:

If you’re offering collateral, make sure you understand the risks of default and asset seizure.

Funding Time

Check how long it takes to:

- Get approved

- Receive the funds

Why it matters:

Traditional banks may take weeks, while online lenders can disburse funds within 24–72 hours. If you need fast capital, speed may outweigh slightly higher costs.

Lender Reputation and Reviews

Read reviews on:

- Customer service

- Transparency

- Loan servicing

- Dispute resolution

Why it matters:

A loan agreement is a long-term relationship. Poor support or hidden clauses can cost you more than just money.

Flexibility and Renewal Options

Some lenders allow early repayment with no penalties or provide top-up options as you build a payment history.

Why it matters:

Flexibility can help you scale or pivot your business without taking on additional high-cost debt.

Tips for Securing the Best Business Loan Rates

- Improve Your Credit Score: Pay off existing debts, correct errors in your report.

- Prepare Financial Documents: Profit & loss statements, tax returns, balance sheets.

- Shop Around: Get quotes from multiple lenders.

- Consider a Co-Signer or Collateral: Lowers risk for lenders.

- Negotiate Terms: Some lenders are open to rate negotiations.

Common Mistakes to Avoid When Applying for a Business Loan

1. Not Knowing Your Credit Score

Many business owners apply for loans without first checking their personal and business credit scores. Since lenders heavily rely on this data, even small discrepancies or negative marks can lead to higher rates—or rejections.

Tip:

Always review your credit reports (from Experian, Equifax, or Dun & Bradstreet for business credit) before applying. Correct any errors and pay down debts if possible.

Applying for the Wrong Type of Loan

Not all loans are created equal. Applying for a short-term loan when you really need long-term capital can hurt your cash flow. Similarly, using a merchant cash advance for equipment purchases might lead to higher overall costs.

Tip:

Align the loan type with your business need. Use SBA loans or term loans for long-term investments, and lines of credit for managing short-term working capital.

Failing to Shop Around

Too many businesses apply with the first lender they come across, without comparing other options. This can cost thousands in interest and fees.

Tip:

Compare at least 3–5 lenders. Look at not just rates, but also terms, fees, and customer reviews.

Submitting an Incomplete or Inaccurate Application

Missing financial documents or incorrect information can delay the process—or worse, lead to denial.

Tip:

Have your documents ready: business bank statements, tax returns, profit and loss statements, balance sheets, and a clear business plan. Double-check everything before submitting.

Not Understanding the Terms

Many borrowers accept loan offers without fully reading the fine print—especially with online or fast lenders. This can result in unexpected fees, prepayment penalties, or rigid repayment terms.

Tip:

Ask for a full breakdown of the APR, fees, repayment schedule, and penalties. Use a financial advisor if needed to review the terms.

Overborrowing or Underborrowing

Taking out too much can lead to unmanageable debt. Taking too little can hinder your growth and force you to take additional loans at worse terms.

Tip:

Create a detailed forecast of how much funding you truly need. Factor in a small buffer, but avoid excess.

Ignoring Your Debt-to-Income Ratio

Even if your credit is good, a high debt-to-income (DTI) ratio can raise red flags for lenders. It indicates you’re already carrying too much financial obligation.

Tip:

Calculate your DTI by comparing total debt payments to monthly revenue. Reduce unnecessary debt before applying if possible.

Not Building a Relationship With a Lender

This is especially true with banks and credit unions. Applying cold—without a relationship—can result in stricter terms or higher scrutiny.

Tip:

Open a business checking account, attend lender webinars, or schedule a pre-application consultation to build rapport.

Assuming Fast Loans Are Always Better

Fast access to cash is appealing, but it often comes at the cost of higher rates, daily repayments, and short loan terms.

Tip:

Only choose quick loans for emergency needs. For planned expenses, go with traditional or SBA loans that offer better long-term value.

Skipping the Exit Strategy

Some borrowers don’t plan how they’ll repay the loan This leads to defaults, damaged credit, and legal complications.

Why Interest Rates Matter for Business Loans

Business loan interest rates affect your monthly payments and the total cost of borrowing. Even a small difference—say, between 8% and 10%—can significantly impact your overall financial burden, especially on long-term loans.

For example, a $100,000 loan at 8% over 5 years costs $121,660, while at 10%, it rises to $127,485. That’s nearly $6,000 in savings, just from a 2% difference.

That’s why it pays to shop around and understand your options thoroughly.

Factors That Determine Your Business Loan Rate

Before diving into specific lenders, it’s important to understand the variables that influence the rate you’ll be offered:

- Annual Revenue: Lenders want to see a solid and growing income.

- Time in Business: Established companies are deemed less risky.

- Industry Risk Level: Some sectors (e.g., restaurants or construction) are seen as higher risk.

- Collateral Offered: Secured loans often have lower rates than unsecured ones.

- Loan Type and Term: Shorter-term loans or lines of credit might have different rates than long-term loans.

Types of Business Loans and Their Typical Rates (2025)

| Loan Type | Average Rate Range |

|---|---|

| SBA 7(a) Loans | 6.5% – 9.75% |

| Traditional Bank Loans | 5.5% – 10% |

| Online Term Loans | 8% – 25% |

| Equipment Financing | 5% – 15% |

| Business Line of Credit | 8% – 24% |

| Invoice Financing | 1% – 3% per month |

| Merchant Cash Advances | 20% – 100%+ (factor rates) |

Top Lenders Offering the Best Business Loan Rates Today

Here’s a curated list of some of the best lenders in 2025 offering competitive rates:

Live Oak Bank (SBA Loans)

- Best for: SBA 7(a) and 504 loans

- Rates: As low as 6.5%

- Terms: Up to 25 years

- Highlights: High loan limits, government backing, flexible use of funds

Bank of America

- Best for: Established businesses with strong credit

- Rates: 5.5% to 9.75%

- Terms: Up to 7 years

- Highlights: Large loan amounts, relationship discounts for existing customers

Bluevine

- Best for: Short-term working capital

- Rates: Starting at 6.2%

- Loan Types: Line of credit

- Highlights: Quick funding, transparent fee structure

Funding Circle

- Best for: Term loans with fast decisions

- Rates: 7% to 22%

- Terms: 6 months to 5 years

- Highlights: No prepayment penalties, ideal for fair-to-good credit borrowers

OnDeck

- Best for: Fast funding for small business owners

- Rates: Starting at 8.5% (APR)

- Terms: 3–36 months

- Highlights: Same-day funding possible, relaxed credit requirements

Celtic Bank

- Best for: SBA loans for startups or low-credit borrowers

- Rates: 6.75% to 9.5%

- Terms: 7 to 25 years

- Highlights: Known for approving newer businesses through SBA programs

Credibly

- Best for: Businesses with low credit

- Rates: 15% to 36%

- Loan Types: Short-term loans, working capital

- Highlights: Approves with credit scores as low as 500

How to Qualify for the Lowest Business Loan Rates

Here’s how you can increase your chances of securing the best possible rate:

Boost Your Credit Score

- Pay bills on time

- Reduce outstanding debt

- Check for errors on your credit report

Maintain Strong Business Financials

- Consistently show profitability

- Keep clean and organized financial statements

- File taxes on time

Offer Collateral

- Collateral reduces risk for lenders and may lower your rate

Build Business Credit

- Establish business credit profiles with agencies like Dun & Bradstreet

5. Shop Around and Compare Offers

- Use marketplaces like Fundera or Lendio

- Ask banks to match competitor rates

When Should You Consider a High-Interest Loan?

There are times when accepting a higher rate might make sense:

- You need fast cash for a limited opportunity

- You expect a quick ROI (e.g., buy inventory that will sell quickly)

- You have a short-term repayment plan

- Your business credit is poor and other options are unavailable

But always compare total repayment amounts and terms before signing.

Tips to Lock in the Best Rate

- Time your application when your revenue and credit are strongest

- Avoid stacking loans, which raises your risk and may hurt future rates

- Choose the Shortest loan term you can comfortably afford

- Negotiate if you have strong financials

- Consider local banks or credit unions, which may offer better deals than national lenders

Also read : What’s a Good Personal Loan Rate for My Credit Score?

Conclusion

Finding the best business loan rates today requires understanding the types of lenders available, the different loans offered, and how your creditworthiness affects rates. Traditional banks and SBA-backed loans usually offer the most favorable terms, but online and alternative lenders provide speed and flexibility. No matter your choice, comparing offers and preparing your financial documentation can significantly improve your chances of securing a loan with a low interest rate.

FAQs

What is a good interest rate for a business loan in 2025?

As of 2025, good business loan rates range between 6% and 12%, depending on credit and lender type.

Can a new business get low-interest loans?

It is possible through microloans, SBA programs, or if the founder has excellent personal credit.

How fast can I get approved for a business loan?

Online lenders can approve and fund loans within 24–72 hours, while banks and SBA loans may take weeks.

Are SBA loans the best option for small businesses?

They offer low rates and long terms, making them ideal, but they require thorough documentation.

Do online lenders charge higher interest rates?

Yes, in exchange for speed and accessibility, online lenders typically have higher APRs.

Is it better to get a fixed or variable interest rate?

Fixed rates provide stability, while variable rates can save money if market rates fall.

Can I refinance a business loan to get a better rate?

Yes, refinancing can lower your rate and monthly payments if your credit or revenue has improve